|

|

|

|

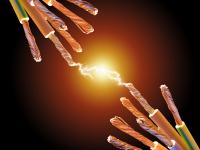

RUSAL gets into electrical discharge

14.02.2011 — Analysis Sverdlovsk officials are beating the alarm: the soaring prices for electrical energy expected for 2011 can mean death for aluminum manufacturers. Experts agree that the situation is really serious, as power-consuming industrial businesses sort ill with free pricing for electricity. As the "RusBusinessNews" columnist has found it out, actually, no country in the world has ever been able to build a competitive power market. In Russia, the situation is aggravated by the mentality of political elites carrying on an uncompromising struggle for aluminum assets. On January 1st, 2011, Russia liberalized the electric energy market. Regulatory authorities abandoned the previous policy of annual increase in rates approximately by 15% and confined themselves to controlling of markups set by retail and transmission companies. The government retains responsibility for establishing flat prices only for residential users. The other consumers have to buy electricity on the open market. The electrical energy sector was not prepared for free pricing. Yuliya Anisimova, head of the Sverdlovsk Territorial Department of the RF Federal Antimonopoly Service, says that the Trading System Administrator has not adjusted itself to the new situation yet; the pricing methods have not been checked through the acid test. The market-based rate will not be established until March-April, and it is likely to be very different from the present target prices set at the level effective as of December. Manufacturers anticipate that after recalculations they will have to pay for electricity one and a half times as much as they are paying now. Vyacheslav Geide, head of the Directorate for Electrical Energy and Capacity Supplies of the Sverdlovsk Power and Gas Company, OJSC, says that consumers cannot understand what they are paying for today and how much they are going to pay tomorrow. The formula for estimation of the power unit cost has been entrenched in agreements signed by buyers; however, market participant are still unaware of the economic indicators (pricing components) applied by generating companies. Accordingly, without the information about amounts of investment and returns on capital, consumers are not able to determine the new power unit cost. At the meeting of the expert group of the Regional Energy Committee of the Sverdlovsk Region, which took place at the beginning of February, subdued sentiments prevailed. Ivan Soloboev, President of SUAL-Holding-Ural, LLC, stated that the Bogoslovsk and Ural aluminum smelters will be able to survive only during a few months at a 50% increase in the rates. The Middle Urals has no hydropower plants, which supply cheap energy to Siberian businesses, and the authorities do not allow the Ural factories of the RUSAL United Company to use energy generated by the Beloyarsk Nuclear Power Plant. Alexei Sokolov, head of the department of the Ministry of Energy, Housing and Public Utilities of the Sverdlovsk Region, claimed that the posed problem cannot be solved at the regional level. With lack of cheap electrical energy, the region is certain to encounter runaway rates. Under such circumstances the regional government can do nothing but state that businesses or even industries will not be able to withstand price flare-ups, though it assures in its willingness to render assistance in development of programs for conversion of power-consuming businesses. Roman Lukichev, a designated representative of the RUSAL United Company for public relation in the Ural Federal District, informed "RusBusinessNews" that it is too early to talk about shutdown of aluminum smelters. However, the virtually uncontrolled growth of energy rates will have an adverse impact on economics of all metallurgical enterprises. Today, we may admit that growth of one sector of economy can damage substantially another sector: the aluminum production cost can exceed its market value after a 50% increase in the rates. Experts do not believe that the RUSAL United Company will go "into the red": today, the company's production cost of one ton of aluminum is 1,600-1,700 USD, and according to the business forecast, the LME price will go up to 2,500 USD in 2011. Therefore, the 250-dollar increase accounting for electricity portion in the production cost is unlikely to make aluminum smelters unprofitable. However, the consequence of the increased rates will be grievous, as businesses cannot quickly and sizably reduce electricity consumption. No "redundant people" are left in the manufacturing factories: according to Vladimir Begalov, Deputy Director of the Institute of Energy Saving, RUSAL laid off even those specialists who worked in the energy saving technology sector. Hopes of metallurgists for government help are rather vague: according to Yuliya Anisimova, supervision over markups of retail and transmission companies will not have substantial influence on pricing - besides, antimonopoly authorities still do not have any instructions and experience concerning detection of abuse on the open market. Thus, the representative of the Department of the RF Federal Antimonopoly Service anticipates numerous conflicts. Experts argue that no other result should be expected: Russia is not ready for market relations in the electric power industry. Embarking on the reform in the Unified Energy Systems of Russia, the Russian government did not take into account that the country does not have excessive generating capacities, most of which need to be upgraded. In most countries, as Fyodor Veselov, head of the laboratory of the Energy Research Institute at the Russian Academy of Sciences, states, the transition to the free market was a natural response to overinvestment in the industry. Due to availability of "extra" capacities, the reformers were able to select the most efficient suppliers and, consequently, decrease prices for electrical energy. Yet, Russia decided to check whether competition could go along well with large-scale investment simultaneously made in the power generation sector. F.Veselov thinks that the experiment will be a failure - because, among other things, the competitive generation market is difficult, if not impossible, to build. Most of the countries have already realized that and started gradually revising their opinions about liberalization of the sector. In a number of cases, competition is organized among investors rather than among electrical power capacities. Having been granted the right to build its generation, the winner of the tender provides electrical energy under special terms and conditions during a certain period of time. The expert says that the similar model was planned in Russia, but the viewpoint of the open market proponents prevailed. Today, the future of this market can already be predicted. Igor Yushkov, an analyst of the National Energy Security Fund, expects that the consumers that will fail to get electrical energy, say, for 10 rubles will buy it for 20 rubles; those who will fail to get it for 20 rubles will agree to 30 rubles and so on. Eventually, following the "best" monopoly traditions of Russia, power producers are most likely to enter into collusive arrangements and to adjust the price to the energy price established at the most costly generating company. Attaining of fair prices will be next to impossible: companies will claim that funds will be spent on thorough overhaul, though, in fact, they will confine themselves to routine repairs. The cost of the performed jobs is very difficult to check. The situation is peppered with politics. I.Yushkov asserts that the very fact of the raised process for electrical energy does not mean that RUSAL's factories will stop their operations. Only the owner can stop production. Saying about laying off employees of aluminum smelters, Oleg Deripaska, actually, bargains with the government, offering to sell him cheap electrical energy from nuclear power plants. However, government elites may not plan for this. The major generating companies (RusHydro, Gazprom Energoholding, Inter RAO, Rosenergoatom, etc.) are accountable to political elites of the "Putin call", which are not averse to getting their hands on the aluminum assets of Oleg Deripaska who rose in business during the days of Boris Yeltsin. The logic of the struggle does not exclude price increase specifically for businesses of the RUSAL United Company. Vyacheslav Geide does not think that in 2011 the rates will increase by 50% according to RUSAL's forecast: "I feel that the increase will not exceed 30%, and it will be associated not only with lack of clarity about purchase cost of electric power based on long-term supply contracts, but also with the decision of some generating companies against participation in competitive selection of capacities. They may have done it for purpose so that the rates would be more attractive than on the competitive market, - the Federal Tariff Service stated. It will make its contribution to price increase". Vladimir Begalov does not exclude that propelling of inflation will be the most significant outcome of the liberalization of the energy market. The prerequisites to this - mentality of the market participants that want to get their margin today, without a second thought whether they will be able to find the buyer for their products tomorrow. Traditions of taking into account consumer interests have not been established in Russia. It also is a sore subject in other countries, but immediate interests are more often sacrificed for the sake of the marketing policy aimed at long-term presence on the market. Today in Russia, there is no sense in talking about future profits of Ural aluminum smelters: nobody knows it. Having liberalized the electric energy market, the authorities do not have any idea what additional amounts they will need to pay electricity for budget institutions, which also plunged into the market. All this frustrates Russians, making them demand government regulation of the rates for electrical energy. Vladimir Terletsky |

| Regions | Project participants | Investment projects | Consulates and Trade Offices | News and Analysis | About the Project |

|

© RusBusinessNews, 2009. All rights reserved. Establishing a hyperlink to RIA RusBusinessNews is required for using any of the material published on this website. News and analytical reviews are translated into foreign languages by the TRANSLIT Translation Agency |

«Sum of technologies»® Web design Site promotion |